Exclusively accessible via our invite-only program, Xplorer is reserved for those who define privilege on their own terms.

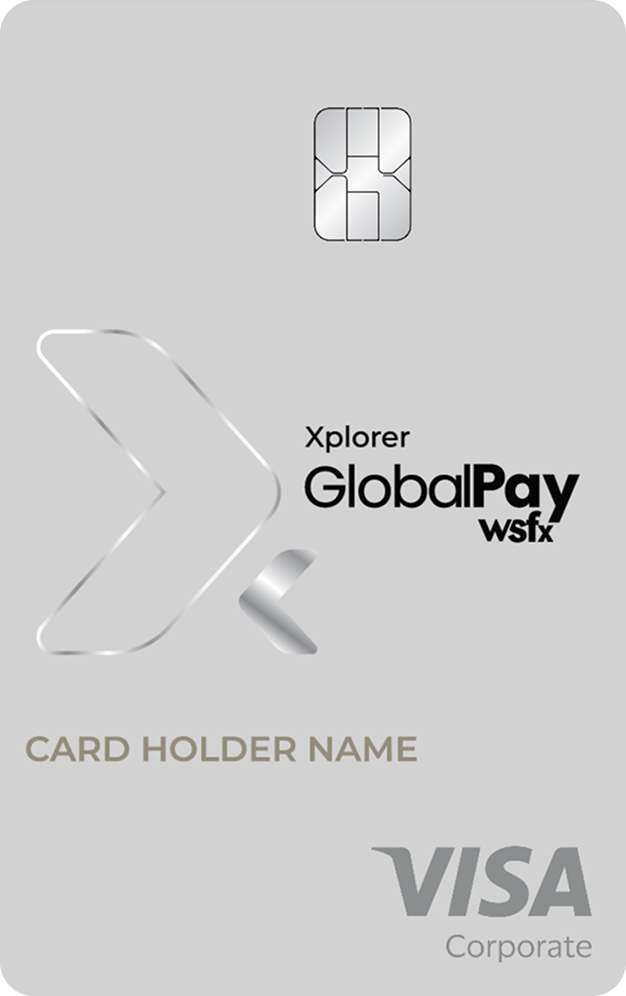

GlobalPay, a trusted name in global payments since 1986, brings its legacy into a new era with Xplorer, India’s first prepaid metal card built on a Pay-Per-Use Freedom model See more ...

Registration

Register online & apply for your Xplorer Card.

Approval process

Please allow up to 7 working days for verification and approval.

Submit documents

PAN and Passport will be required for activation.

Activation Complete

Your Xplorer is now activated and will be securely couriered to your doorstep.

Xplorer is India’s first prepaid metal global card built on a Pay-Per-Use Freedom model. No tiers, no badges, no hidden charges, only freedom to use services on your terms.

The Xplorer Card is crafted from 18g stainless steel with a brushed matte finish, fingerprint-resistant surface, and precision engraving. At just 0.3 mm ultra-slim thickness, it is both lightweight and durable, designed as a true lifestyle statement.

Unlike traditional cards with bundled or unused services, you only pay for what you use. For example, spa, golf, or lounge access is charged only when availed, no mandatory packages or annual fees. Click here to locate a WSFx Branch.

The Xplorer Card can be used only for international transactions.

There is no cross-currency fee on the Xplorer card.

No, there are no load/reload fees.

It means you can withdraw your unused forex balance back into INR without any additional charges.

No, there are no hidden charges with Xplorer.

No. Xplorer is currently running as an invite-only program, and there is no annual or subscription fee during this phase. The card’s MRP is ₹9,999, but your invite secures you zero card fee access for early members.

Xplorer supports 12 currencies: USD, GBP, EUR, CHF, CAD, AUD, SGD, HKD, THB, AED, SAR, ZAR.

Yes, with zero-cost wallet-to-wallet transfers.

You can reload anytime and anywhere from our app.

Global Airport lounge access, Airport transit hotels, Visa at doorstep services & visa lounges, Global eSIM connectivity, Excess baggage support & baggage wrapping.

Simply choose the service you want and pay only when you use it. There are no mandatory costs for packages.

Yes, Xplorer includes a global eSIM for seamless connectivity while traveling.

For an updated schedule of fees Click here. Valet parking, spa indulgences, curated dining, coffee at partner outlets, golf access, global clubs, and premium lounges.

As part of your Xplorer kit, you receive 4 complimentary global lounge passes per year, along with a Global SIM. These lounge passes expire at the end of the year if unused. All additional services follow the Pay-Per-Use model.

Yes, you can book services like visa assistance, lounges, and hotels through the Xplorer Card.

Everyone can apply but current it is only on invite only program where we will review the application and accept or reject accordingly.

You will need a valid PAN card, a Passport, and address proof for KYC compliance.

Click Register Now to join the waitlist. Approved applicants will be invited.

Within 7 working days of approval, the card will be couriered to you.

Currently, Xplorer is issued only to Indian residents. NRIs and foreign nationals are not eligible.

In addition to GlobalPay’s RBI-compliant security, the card comes with EMV chip + NFC technology for secure, contactless transactions worldwide.

block the card immediately from card management in our GlobalPay app and contact immediate on our 24/7 customer care.

Yes, Xplorer comes with fraud protection, and add-on travel insurance is available.

You can reach out to Customersupport@wsfxglobalpay.com

Yes, Customer support is available 24/7.

Yes, the GlobalPay app lets you load/reload, switch currencies, track expenses, book services, and access privileges.

Yes, through the GlobalPay app, you can control limits, load/reload your card.

Yes, you will receive instant notifications for every transaction, keeping you in full control of your spending.

Xplorer Global Card is globally accepted in 180+ countries, at 100M+ outlets, online, and across ATMs. Click here to know more.

Yes, Xplorer allows ATM withdrawals across the globe with zero withdrawal fees.

Yes, you can invite friends to join Xplorer through our referral program. Both you and your friend earn exclusive lifestyle and travel rewards.

Instead of chasing points or tiers, Xplorer gives you pay-per-use lifestyle privileges and curated experiences tailored to your journey.

You can load multiple currencies freely, subject to the USD 250,000 annual limit under RBI's LRS, which covers all outward remittances, including forex card loads.

The card is valid for 5 years from the date of issue and can be renewed seamlessly.